tax refund calculator ontario 2022

The lowest federal tax rate is 15. However the child will only receive 50 of this amount or 2000.

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

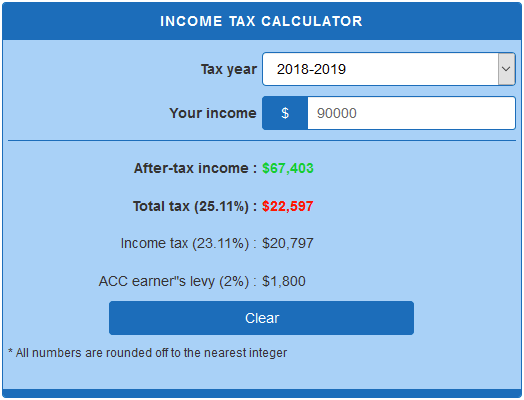

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

. An example is the GSTHST. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate. The maximum tax refund is 4000 as the property is over 368000.

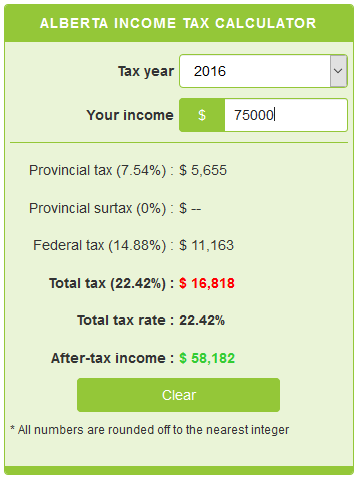

For example in Ontario the lowest rate is 505. Examples include the basic personal amount which is 14398 for 2022 and the first-time home buyers amount. Provincially tax rates vary.

Canadian Payroll Calculator 2022. 2021 free Ontario income tax calculator to quickly estimate your provincial taxes. At what credit rate does the government give the Medical Expense Tax Credit.

Before you use the calculator we want you to understand that the Disability Tax Credit refund is comprised of. ET for French during tax season from February 22 to May 2 2022. The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475.

View the table or use our RRIF withdrawal calculator to find out. This is equal to the median property tax paid as a percentage of the median home value in your county. The parent will receive no tax refund.

In some circumstances such as tax credits for tuition student loan interest and donations can be carried forward for future years. Adjustments to beer basic tax rates. Calculating how much money you will be receiving from the CRA once you are found eligible for Disability Tax Credit is a little complex so tried to simplify it by creating the Disability Tax Credit calculator.

Please enter your income deductions gains dividends and taxes paid to. In Ontario tax brackets are based on net. Estimate your tax refund.

Prince Edward Island tax calculator. Save up to 10 on your tax filing with TurboTax Canada. For example on a 341mL bottle of beer made by a microbrewer purchased on March 15 2022 the beer basic tax will be 0341L 03975L 01355.

The government gives this credit at the lowest marginal tax rate. Valid until 050222. More About This Page.

Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. And it will show you how much taxes you still owe or how much refund you can expect. Use our Tax Calculator to estimate how much you owe to CRA If you have income from sources other than employment use our tax calculator.

In our calculator we take your home value and multiply that by your countys effective property tax rate. Calculating Your Disability Tax Credit Benefits. 4000 in taxes and you have 4500 in non-refundable tax credits you can claim 4000 but you dont get 500 as a refund.

View the 2022 RRIF minimum withdrawal table. How New York Property Taxes Work. A refundable tax credit lowers your taxes owing and can result in a tax refund if you have excess tax credits.

Ontario Tax Brackets 2021 - 2022. After May 2 English and French hours of operation will be 9 am. Added together with the federal rate this makes the lowest marginal tax rate in.

To 6 pm ET Monday. The total Ontario land transfer tax would be 6475 - 2000 4475. A non-refundable tax credit can only lower the taxes you owe.

The beer basic tax rates are adjusted based on the Consumer Price Index for Ontario over the past three years. Ministry of Finance Land Taxes Section 33 King Street West Oshawa ON L1H 8H9. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021.

Your actual property tax burden will depend on the details and features of each individual property. Find out your tax refund or taxes owed plus federal and provincial tax rates. Send your letter to the Ministry of Finance by.

They do not result in a tax refund. 1120 Bay Street Gravenhurst Ontario Canada P1P 1Z9 1-888-970-1470 Comodo SSL. If you request a refund for overpayment of Non-Resident Speculation Tax a completed Ontario Land Transfer Tax RefundRebate Affidavit with section 1 completed.

CANADA - Here are the Minimum RRIF Withdrawal Rates.

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

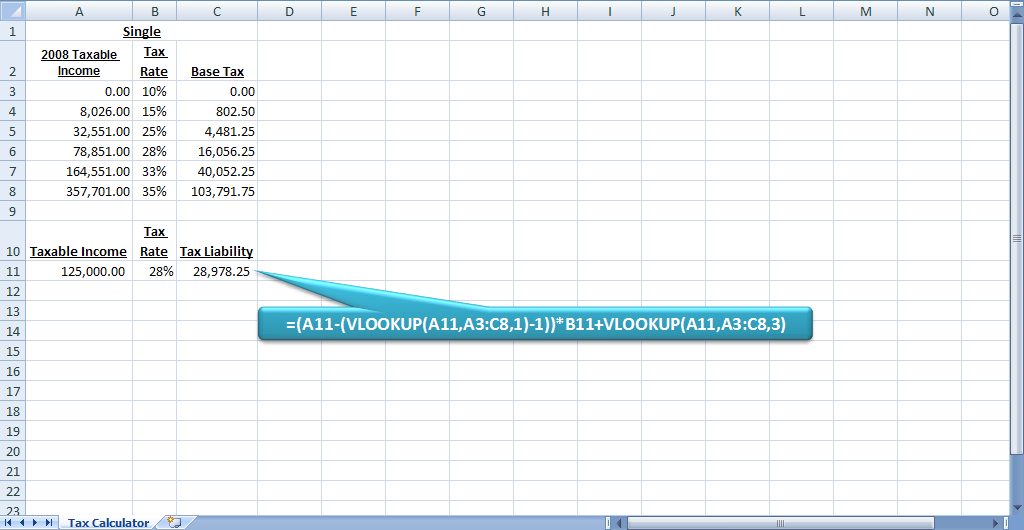

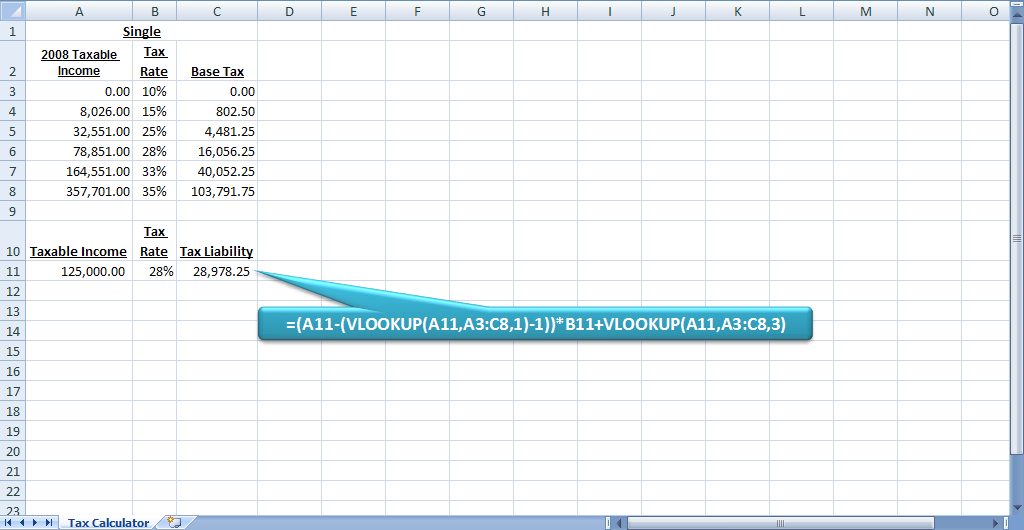

How To Calculate Income Tax In Excel

Australian Income Tax Calculator Calculatorsworld Com

How To Create An Income Tax Calculator In Excel Youtube

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Calculator For Salary Flash Sales 59 Off Www Turkishconnextions Co Uk

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

How To Calculate Income Tax In Excel

Tax Calculator For Salary Flash Sales 59 Off Www Turkishconnextions Co Uk

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

How To Calculate Foreigner S Income Tax In China China Admissions

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger